The Debt

/By Don Varyu

Oct 2024

t was predictable, I guess, that genius inventor/deranged human Elon Musk would eventually jump on the bandwagon lamenting the disastrous, looming national debt. He raised it as a campaign issue supporting Donald Trump, since Trump himself is hardly blameless in the looming.

I’ve heard these warnings my entire adult life, but really can’t make much sense of them. After all, we’re still here and, in possession of what’s said to be the world’s strongest economy. But at the same time, it’s also true that the debt keeps getting bigger.

So I tried to boil down to the basics of the facts and the argument, and this is what I came up with:

The “debt” and the “deficit” are two different things. For purposes of government, the deficit is the balance sheet for a single year. (The last time we showed a surplus were under Bill Clinton in the 90’s.) The debt is the amount left when all previous years’ deficits are added together. To translate this to personal terms, the deficit could be what you made versus what you spent in a single year. The debt is the balance of everything you own (cash, investments, property) against everything you owe (credit card debt, car loans, mortgages, etc.).

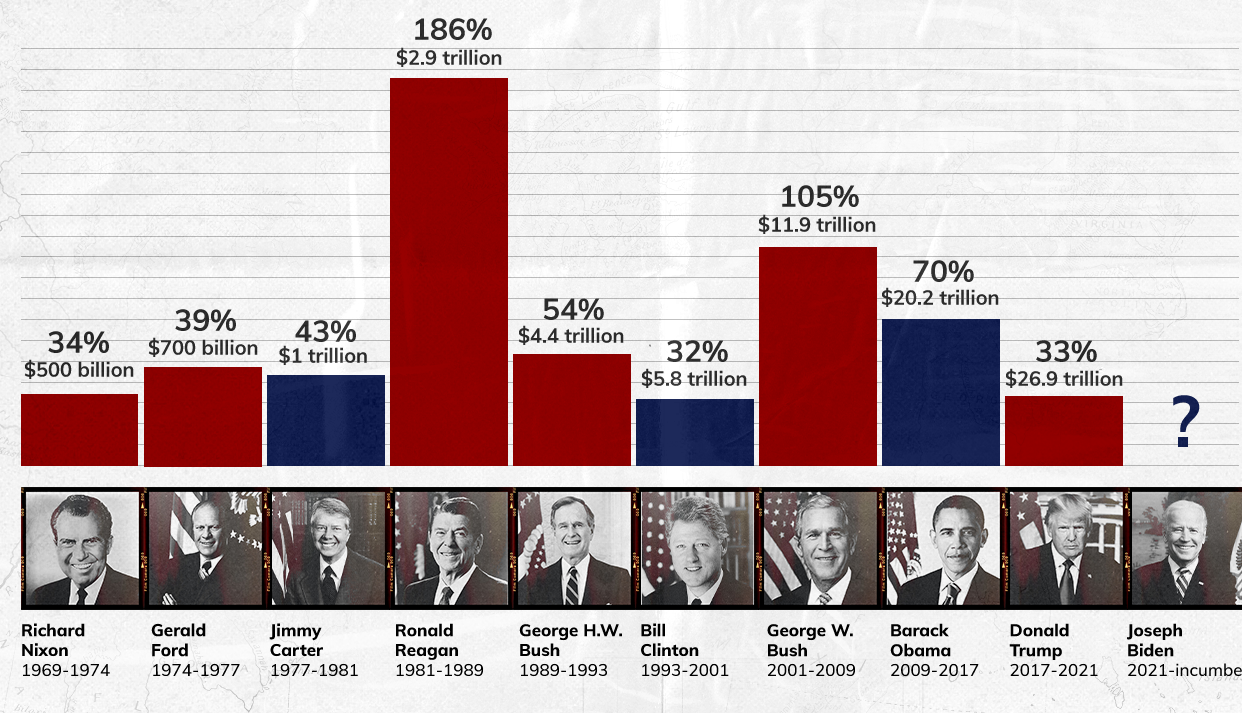

The U.S. debt leaped under both Trump and Biden. For each, pandemic payments to individual American households and businesses were significantly responsible. Under Trump, the debt was aggravated by tax cuts aimed primarily for rich and the biggest corporations. Under Biden, expensive initiatives like infrastructure and climate control contributed to his increases.

Government spending is only part of the actual total debt in America. Financial institutions hold the most total debt… followed by the government;…and then the total that all consumers owe.

America has the world’s largest debt—but also its largest economy. This is important because the ratio between the two defines the ability of a nation to carry debt. On this scale, the U.S. is in the middle of all developed countries. Thus, we carry a smaller risk than you might think for suddenly “going broke.”

The largest component of our debt is what we owe in interest payments on U.S. treasury bills purchased by buyers, including foreign countries. Those nations shop “America-first” because we are the most trusted investment in the world—despite our debt.

China does not hold the largest amount of foreign-owned U.S. debt. Japan does. I have heard this said: the world’s total debt exceeds the world’s total assets. In other words, if this is true, the global economy is a house of cards. If everyone suddenly demanded, “pay up!” at the same time, there wouldn’t be enough money to meet that demand. (Maybe it would help to remember Jimmy Stewart during the bank rush in “It’s a Wonderful Life”). But since everyone is in the same situation, no one wants to pull out the bottom card. In a global collapse, no one would win. (While it’s true that Greenland and the British Virgin Islands are among a very small group of very small nations with virtually no debt, it is highly unlikely that, even working together, those countries could topple the entire world economy.)

Even trying to make all this simple can quickly become complicated.For example, there’s a gaggle of tech bros in Silicon Valley saying everything can be solved by simply shifting our economy to cryptocurrency. After all, Donald Trump himself has introduced what is, in effect, his own crypto.

Meanwhile, Sen. Elizabeth Warren has said a country like America is so big it can never run out of money, so just keep spending.

I’ll stop there.

To bring this back to politics, just two points. First, there is no question that America would be even stronger if we could cut the gap between the amount of money we collect in taxes and the amount we spend. And there is a huge army of pols, financiers, academics and authors who make good livings prescribing exactly how this should be done. Tax more? Spend less? And exactly how? These arguments will never end.

Second, there is a constant blame game between the GOP and Democrats over who’s “to blame” for this situation. The straight answer is they both are, but some are more guilty than others. The chart below doesn’t count by dollars, a method which discounts inflations. Instead, it notes the percentage the debt jumped under the administrations of each president, starting with Nixon:

It is difficult to imagine that there is a magic debt total that would bring down the U.S. economy—and subsequently, the world’s. After all, as we’ve demonstrarted, the federal government can live beyond its means. But most states and local municipalities have laws or constitutions that outlaw that.

So I guess that means the debt is pretty much like everything else: the bigger you are, the more you can get away with.

Have a comment or thought on this? Just hit the Your Turn tab here or email us at mailbox@cascadereview.net to have your say.